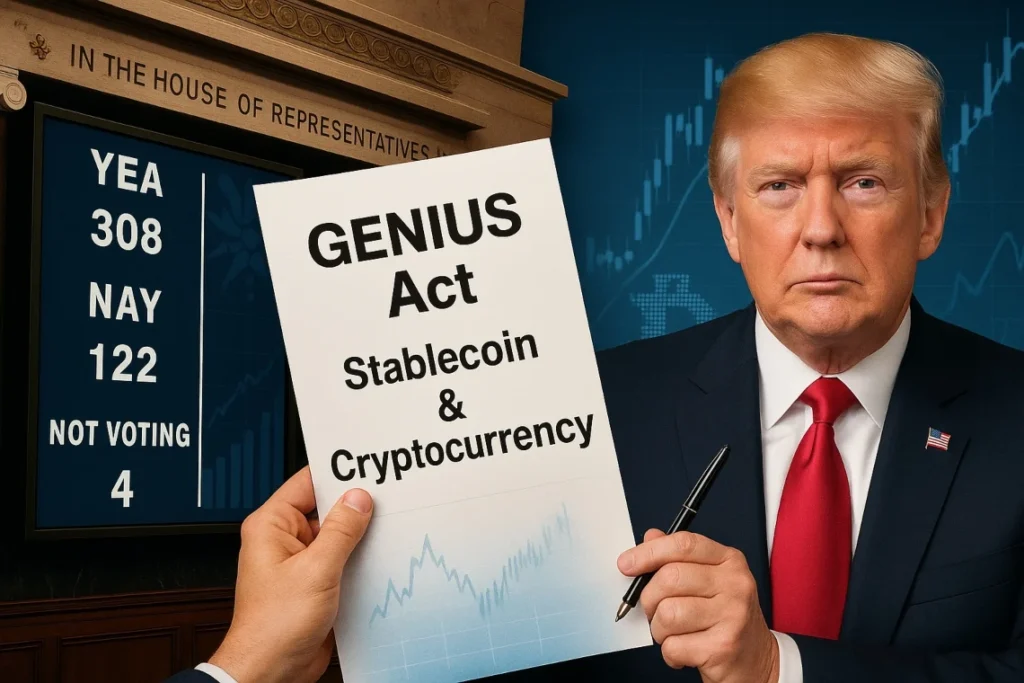

The GENIUS Act Explained: A Revolutionary Shift for Stablecoins and Crypto in 2025

The GENIUS Act (Guiding and Establishing National Innovation for U.S. Stablecoins Act), signed into law in July 2025, is widely regarded as a landmark moment for cryptocurrency regulation. It’s the first major federal legislation in the U.S. that provides a comprehensive, clear, and structured legal framework for stablecoins. Here’s why it marks a true revolution:

🔍 What Is the GENIUS Act?

The GENIUS Act is a bipartisan U.S. federal law that:

- Establishes rigorous regulatory standards for stablecoins pegged to the U.S. dollar

- Requires strict 1:1 backing with cash or short-term Treasuries

- Enforces monthly reserve reporting and third-party audits

- Sets rules for anti-money laundering (AML), consumer protection, and bankruptcy safeguards Business Insider+15Reuters+15LiveNOW+15CBS News+5Wikipedia+5LiveNOW+5The Washington Post+5WilmerHale+5Thomson Reuters Tax+5The Verge

🏛 Why It’s a Turning Point for Crypto

1. 🔒 Regulatory Clarity

This is the first time stablecoins have been placed under a formal federal legal framework. Before this, U.S. regulation was vague and inconsistent across states. Now, financial institutions, fintechs, and startups have definitive guidelines WilmerHalePillsbury Law.

2. 🏦 Institutional Participation

By enabling banks, credit unions, and OCC-chartered entities to issue stablecoins, the GENIUS Act encourages real-world adoption. Retail giants like Amazon and Walmart are already exploring coin issuance aimed at reducing transaction costs Pillsbury Law+3Business Insider+3WilmerHale+3.

3. 💵 Dollar-Backed Integrity

Every stablecoin must be backed 1:1 with liquid U.S. assets, with monthly audits and public transparency. This builds trust and shields users from the instability seen in earlier unbacked or under-backed coins Wikipedia+2Reuters+2Cinco Días+2.

4. 🏦 Expanded Fed Integration

While requiring stricter compliance, the GENIUS Act doesn’t exclude issuers from Federal Reserve services like master accounts, paving the way for seamless integration with existing banking infrastructure Forbes+15WilmerHale+15Pillsbury Law+15.

💡 Why It’s a Revolution

A. From Unregulated to Mainstream

Stablecoins are transitioning from a fringe asset to part of everyday finance—openly regulated, bank-issued, and fully transparent. That legitimacy is unprecedented for the crypto world MarketWatchReutersWilmerHale.

B. Consumer and Investor Protection

The law mandates:

- AML procedures under the Bank Secrecy Act

- Priority claims for users during issuer insolvency

- Public disclosure of reserves and liabilities Congress.gov+4WilmerHale+4Morgan Lewis+4ABC NewsThe Washington Post+2Reuters+2Yahoo Finance+2

This framework ensures user security like never before.

C. Anchoring the U.S. Dollar’s Dominance

By tying stablecoins to Treasuries, the Act supports demand for federal debt and preserves the dollar’s global influence—especially as other nations race ahead with CBDCs (e.g., China’s e-CNY) New York Magazine+2Reuters+2Barron’s+2.

🔮 Immediate Impact & Market Reaction

Crypto markets reacted instantly. Following the Act’s signing:

- Total market cap surged past $4 trillion

- Bitcoin hit new highs (~$123k), Ethereum surged ~20%

- Stablecoins rallied, with analysts forecasting size could reach $3.7 trillion by 2030 Reuters+2LiveNOW+2New York Post+2New York PostCBS News+2Reuters+2New York Post+2

This validates the GENIUS Act’s transformative effect on crypto confidence.

🧩 Core Provisions Making the Revolution Possible

- Issuer Eligibility

- Only FED-insured banks, credit unions, OCC-chartered firms, and state-regulated institutions may issue “payment stablecoins”

- Foreign issuers must meet U.S. standards for AML, sanctions, and consumer protection Cinco Días+15WilmerHale+15Pillsbury Law+15

- Reserve Requirements

- 1:1 backing with cash, short-term Treasuries, or Fed deposits

- Funds held in dedicated reserves audited monthly Wikipedia+3Pillsbury Law+3Cinco Días+3Thomson Reuters Tax

- Transparency and Audit Rules

- Monthly disclosures and certified independent audits

- Misrepresentation of government backing is prohibited Thomson Reuters Tax

- Consumer Protections

- Bankruptcy priority for holders

- Access to freezing & seizure under lawful compliance

- Issuers must register under BSA and maintain sanctions compliance ABC NewsReuters+9The White House+9WilmerHale+9

- Phase-In Timelines

- Most provisions become effective 18 months after enactment, or sooner upon final regulation

- A grace period of up to 3 years for existing non-compliant assets MarketWatch+1Pillsbury Law+1WilmerHalearxiv.org+6The Verge+6Reuters+6

🌉 The Path to Real-World Adoption

| Timeline | Milestone |

|---|---|

| 180 days post-enactment | Agencies draft rulebooks (Treasury, OCC, Fed) Forbes+5Morgan Lewis+5WilmerHale+5 |

| 18 months | Licenses required for stablecoin issuance |

| 3 years | Non-compliant assets barred from U.S. operations |

This rollout gives issuers time to realign operations while signaling long-term regulatory clarity.

Additionally, a regulatory dual framework allows states to license stablecoins (under federal oversight), fostering innovation without fragmentation The Verge+12Pillsbury Law+12MarketWatch+12.

📊 Broader Implications

- Banks & Fintechs: Encouraged to enter the space with lower overhead and faster settlement than legacy systems Business InsiderPillsbury Law

- Consumers: Stand to benefit from cheaper, faster cross-border and domestic payments, though some loss of FDIC insurance is a concern MarketWatch

- Global Crypto: Paves the way for U.S.-regulated stablecoin dominance amid international competition CBS News+13Reuters+13LiveNOW+13

⚠️ Criticisms & Risks

- Some worry the Act favors Big Tech and big banks, limiting independent innovation The Daily Beast+3The Verge+3New York Magazine+3

- Tethering massive reserves to Treasuries could stress markets during rapid redemptions WilmerHale

- Privacy advocates are wary of AML-induced surveillance

- The risk of political conflicts, given exemptions for the president and family, was flagged by watchdogs LiveNOW

Stablecoin $10 Billion Income Rule Explained: What It Means for Crypto Issuers in 2025

🧭 Final Verdict: A New Era for Stablecoins

The GENIUS Act heralds a fundamental shift in how stablecoins operate in the U.S. By bringing transparency, regulatory clarity, and institutional credibility, it transitions stablecoins into the mainstream—making them reliable instruments for payments, treasury, and even global finance.

For consumers, the promise is safer, faster, and cheaper digital dollars. For institutions, it’s a green light to innovate on the blockchain. For investors, it signals a maturing crypto sector—with greater legitimacy and participation.

The revolution has begun—and stablecoins are at the heart of it.