ITR 2025 Last Date Extension Rumors: What’s Real and What’s Not?

ITR 2025 Last Date Extension Rumors: What’s Real and What’s Not?

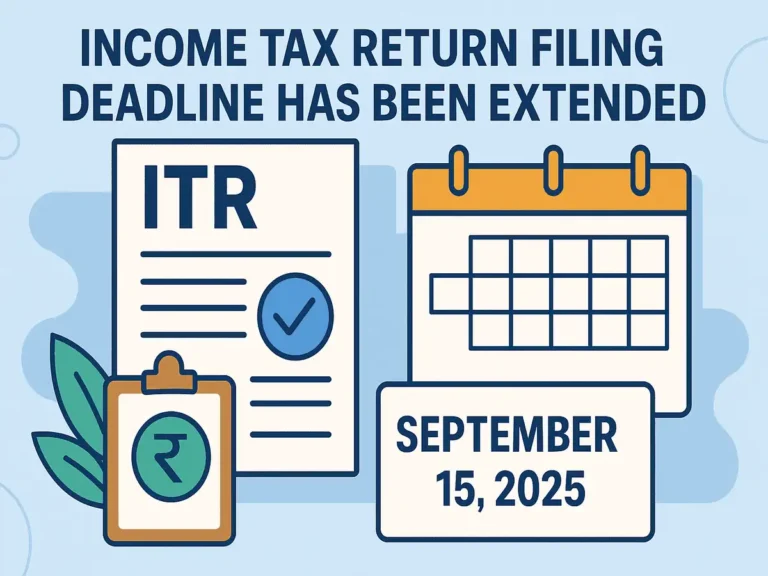

Every year, Indian taxpayers find themselves surrounded by rumors about the Income Tax Return (ITR) filing deadline. In 2025, it’s no different. As the original due date — July 31, 2025 — approached, social media, WhatsApp groups, and forums began buzzing with news of a possible extension. But is there any truth to these rumors? Has the ITR filing deadline been officially extended?

In this blog post, we’ll decode the current situation, separate facts from fiction, and provide you with everything you need to know about the ITR filing deadline for Assessment Year (AY) 2025–26 — in simple words. Ideal for individuals, salaried employees, freelancers, small businesses, and pensioners.

ITR 2025 Last Date Extension Rumors: What’s Real and What’s Not?

🔍 What Is the Original ITR Deadline for FY 2024–25 (AY 2025–26)?

The standard ITR filing deadline for individuals and non-audit taxpayers is July 31, 2025.

This applies to:

- Salaried employees

- Freelancers

- Pensioners

- Hindu Undivided Families (HUFs)

- Small business owners not requiring audit

Those whose accounts require audit usually get time till October 31, 2025.

🔥 Are the ITR 2025 Deadline Extension Rumors True?

As of mid-July 2025, the rumors are partially true — but with a twist.

Latest Updates (as per CBDT notifications and media sources):

- The deadline has been extended to September 15, 2025, for non-audit cases only.

- The reason cited includes delays in the release of updated ITR forms, glitches in the e-filing portal, and delay in availability of Form 16 and TDS data.

So, the rumored extension turned out to be real, but only for select taxpayers.

ITR 2025 Last Date Extension Rumors: What’s Real and What’s Not?

📝 Why Does the Government Extend ITR Deadlines?

Over the years, the Indian government has frequently extended ITR deadlines for various reasons:

1. Technical Glitches on the e-Filing Portal

If the income tax portal faces slowdowns or crashes, many users can’t file returns on time.

2. Delay in Issuing Form 16 or TDS Statements

Employers and banks sometimes delay issuing Form 16 or TDS certificates, making it hard for individuals to verify income details.

3. Changes in ITR Forms

Whenever the government updates ITR forms or adds new compliance sections (e.g., for crypto income, foreign assets, or capital gains), taxpayers need more time to understand and file accurately.

4. Public Pressure

Taxpayer associations, CAs, and industry groups often petition the government for deadline extensions — especially when documentation or portal readiness is delayed.

✅ What Is the Current ITR Deadline for AY 2025–26?

| Category | Original Deadline | Extended Deadline (if any) |

|---|---|---|

| Individual (Non-Audit) | July 31, 2025 | September 15, 2025 ✅ |

| Business (Audit) | October 31, 2025 | No Change ❌ |

| Companies & LLPs (Audit) | October 31, 2025 | No Change ❌ |

Note: If you are not liable for a tax audit, you now have till September 15, 2025, to file without penalty.

ITR 2025 Last Date Extension Rumors: What’s Real and What’s Not?

⚠️ What Happens If You Miss the New Deadline?

Missing the ITR deadline can lead to:

1. Late Filing Penalty (Section 234F)

- ₹1,000 for income below ₹5 lakh

- ₹5,000 for income above ₹5 lakh

2. Interest on Tax Due (Section 234A)

If you owe any tax, you’ll be charged 1% interest per month from the original due date.

3. Delayed Refunds

Late filing often results in delayed refunds from the Income Tax Department.

4. Loss of Carry Forward Benefits

You won’t be able to carry forward capital losses or business losses to the next year.

📊 Reasons Why This Year’s Extension Was Necessary

Several key developments this year made a deadline extension almost inevitable:

➤ Delayed Form 16 from Employers

Many companies distributed Form 16 only in late June or early July, leaving insufficient time for taxpayers to reconcile TDS details.

➤ Capital Gains and Crypto Tax Disclosures

The new ITR forms require granular reporting of capital gains and crypto asset transactions, causing confusion among first-time investors.

➤ High Volume of Filings

The income tax portal experienced record-high traffic in July 2025, creating lags and login issues for users.

➤ Portal Issues in Pre-filled Data

Pre-filled data (TDS, salary income, interest from banks, etc.) had errors or missing entries, making many taxpayers hesitant to submit their returns.

📅 How to Prepare and File ITR Before September 15, 2025

Don’t wait until the last moment. Here’s a checklist to help you file early:

✅ Documents Checklist:

- Form 16 (from employer)

- Form 26AS (TDS summary)

- AIS (Annual Information Statement)

- PAN and Aadhaar

- Bank interest certificates

- Capital gains reports (mutual funds, stocks, crypto)

- Home loan interest certificate (if applicable)

- Health insurance premium receipts

🧾 Steps to File:

- Log in to incometax.gov.in

- Choose the correct ITR form (ITR-1, ITR-2, etc.)

- Upload your data manually or via pre-fill

- Pay any tax due (via challan)

- Submit and verify via Aadhaar OTP or net banking

💡 Pro Tip: File Early to Get Faster Refunds

Many early filers reported receiving refunds within 7–15 days in 2024. Filing early also:

- Helps you avoid last-minute portal crashes

- Gives you time to revise in case of errors

- Makes you eligible for higher interest on refunds (under Section 244A)

🧯 FAQs on ITR 2025 Filing

❓ Is the deadline extended for everyone?

No, only for individuals and non-audit taxpayers.

❓ Do I need to pay interest if I file by September 15?

If your entire tax is paid, no interest is applicable. But if you delay paying tax, interest applies from July 31.

❓ What if I miss September 15?

You can still file a belated return until December 31, 2025, but you’ll have to pay late fees.

🚨 Beware of Fake News & Social Media Rumors

Always confirm updates on:

- incometax.gov.in

- Official CBDT press releases

- Government of India’s PIB handles

- Trusted tax platforms like ClearTax, TaxBuddy, and CAClubIndia

✍️ Final Thoughts

The extension of ITR filing deadline to September 15, 2025, has given relief to millions of Indian taxpayers. But don’t let the extra time make you complacent.

Take advantage of the extension to:

- Review your documents

- Avoid errors

- Claim all deductions

- File early for faster refunds

Stay updated through official sources and avoid getting trapped by rumors. With tax compliance becoming stricter each year, it’s always best to file timely and accurately.

👉 Quick Summary:

- ✅ New ITR deadline (non-audit cases): September 15, 2025

- ❌ No extension for audit cases

- 🧾 File early for faster refund

- ⚠️ Late fees + interest apply after the new due date

📌 Stay informed. File smart. Be a responsible taxpayer.