ITR-1 to ITR-5: Which Income Tax Form Do You Need to File in FY 2024-25?

Table of Contents

Keywords: ITR-1 vs ITR-2, Which ITR form to file, ITR form guide India FY 2024-25, Income tax return simplified, Who can file ITR-3 or ITR-4, Income tax form types for salaried individuals

ITR-1 to ITR-5: Which Income Tax Form Do You Need to File in FY 2024-25?

📌 Introduction: Why Choosing the Right ITR Form Matters

As the Income Tax Return (ITR) filing season for FY 2024-25 begins, one of the most common questions is:

“Which ITR form should I use?”

Whether you’re a salaried professional, a freelancer, a business owner, or someone earning rental or capital gains income, the Income Tax Department has categorized taxpayers and income types into various ITR forms, from ITR-1 to ITR-7.

In this post, we’ll focus on ITR-1 to ITR-5, the most commonly used forms by individuals and professionals.

🧾 What Is an ITR Form?

An ITR form (Income Tax Return form) is a prescribed format by the Income Tax Department of India used to file your tax returns for a financial year.

Each ITR form serves a specific category of taxpayer and type of income. Filing the wrong form can lead to rejection of the return, penalties, or notices.

ITR-1 to ITR-5: Which Income Tax Form Do You Need to File in FY 2024-25?

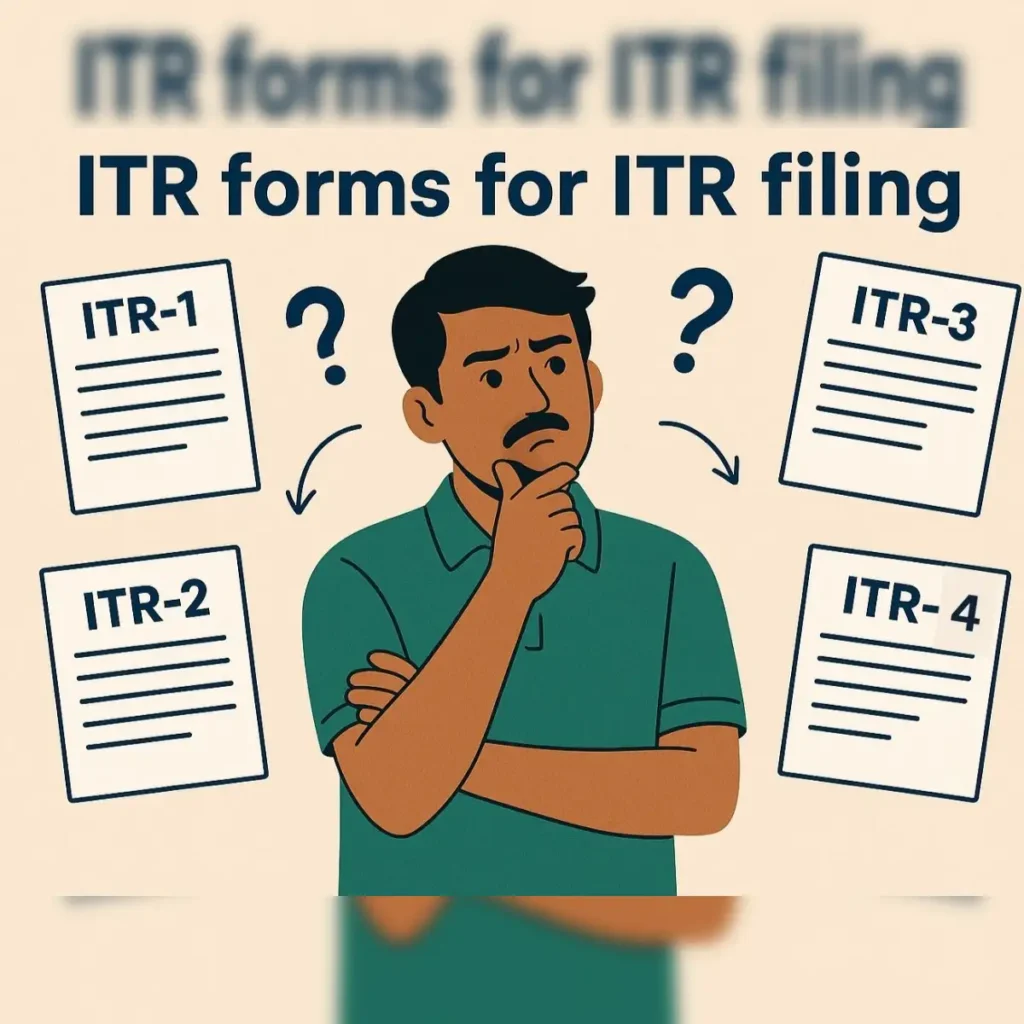

✅ ITR-1 (SAHAJ): For Salaried Individuals

👥 Who Can Use It?

- Resident individuals (not HUF or companies)

- Income up to ₹50 lakh

- Sources of income:

- Salary or pension

- One house property

- Other income (interest, FD, savings account, family pension)

❌ Who Cannot Use It?

- Non-residents (NRI)

- Directors in companies

- People who have invested in unlisted shares

- Income from capital gains or more than one house property

🧠 Ideal for:

- Most salaried individuals with simple income sources

✅ ITR-2: For Individuals With Capital Gains or Multiple Properties

👥 Who Can Use It?

- Individuals/HUFs who:

- Have capital gains (from stocks, mutual funds, real estate)

- Own more than one house property

- Are non-residents or RNOR

- Earn foreign income or hold foreign assets

❌ Who Cannot Use It?

- Anyone with income from business or profession (use ITR-3)

🧠 Ideal for:

- Investors, NRIs, and high-net-worth individuals

✅ ITR-3: For Business Professionals and Freelancers

👥 Who Can Use It?

- Individuals/HUFs who earn income from:

- Proprietary business or profession

- Partnership income (not as a firm)

- Freelancing, consultancy, technical services

- Intraday trading, F&O, crypto trading

Includes salary, house property, capital gains as well.

🧠 Ideal for:

- Freelancers

- Doctors, lawyers, consultants

- Traders (equity, F&O, crypto)

✅ ITR-4 (SUGAM): For Presumptive Taxpayers

👥 Who Can Use It?

- Individuals, HUFs, and Firms (not LLP) under presumptive taxation schemes (Sections 44AD, 44ADA, 44AE)

- Business turnover up to ₹2 crore

- Professional income up to ₹50 lakh

❌ Who Cannot Use It?

- If you have foreign income or capital gains

- If you hold unlisted equity shares

- If you’re a director in a company

🧠 Ideal for:

- Small businesses

- Freelancers using 50% deemed profit (44ADA)

- Transport business under 44AE

ITR-1 to ITR-5: Which Income Tax Form Do You Need to File in FY 2024-25?

✅ ITR-5: For Firms, LLPs, AOPs, and BOIs

👥 Who Can Use It?

- LLPs (Limited Liability Partnerships)

- Firms (other than individuals or HUFs)

- Association of Persons (AOP)

- Body of Individuals (BOI)

Used to report income, profit-sharing, partner details, etc.

❌ Who Cannot Use It?

- Individuals or HUFs (use ITR-1 to ITR-4)

- Companies (use ITR-6 or 7)

🧠 Ideal for:

- Registered firms and LLPs

- Group entities or co-owned businesses

📅 Important Dates for ITR Filing (FY 2024-25 / AY 2025-26)

| Category | Last Date to File ITR |

|---|---|

| Individual (no audit) | 31st July 2025 |

| Business (with audit) | 31st October 2025 |

| Companies or LLPs (audit) | 31st October 2025 |

| Tax audit with TP report | 30th November 2025 |

📍 How to Choose the Right ITR Form?

Here’s a simple checklist:

| Criteria | Suggested ITR |

|---|---|

| Only salary income | ITR-1 |

| Salary + Capital Gains | ITR-2 |

| Business/Freelancing Income | ITR-3 |

| Presumptive scheme (44AD/ADA) | ITR-4 |

| Partnership Firm or LLP | ITR-5 |

✅ Common Mistakes to Avoid

- ❌ Filing ITR-1 with capital gains

- ❌ Using ITR-4 when actual books are maintained

- ❌ Declaring incorrect residential status

- ❌ Missing foreign assets declaration (ITR-2/3 only)

- ❌ Ignoring interest income from savings or FD

📌 Can I File My ITR Myself?

Yes! You can file it:

- ✅ On the Income Tax e-Filing Portal

- ✅ Through offline utilities (JSON-based)

- ✅ Using platforms like ClearTax, TaxBuddy, or Groww

Make sure:

- PAN, Aadhaar are linked

- Form 16, AIS, and TDS details are verified

- E-verification is done via Aadhaar OTP or net banking

Ask ChatGPT