how-do-cashback-apps-make-money

How Do Cashback Apps Make Money? A Deep Dive into Their Monetization Strategies

Cashback apps have become increasingly popular among shoppers looking to save money on their purchases. But have you ever wondered how these apps generate revenue while giving users cash rewards?

In this blog post, we’ll explore the different monetization strategies cashback apps use to stay profitable while offering attractive deals to consumers.

1. Introduction: The Rise of Cashback Apps

Cashback apps like Rakuten, Honey, and Swagbucks have gained massive popularity by offering users a percentage of their spending back as rewards. These apps partner with retailers, brands, and financial institutions to provide discounts and rebates.

But if users are getting money back, how do these apps sustain themselves? The answer lies in multiple revenue streams, including affiliate commissions, advertising, and premium memberships.

2. How Cashback Apps Work

Before diving into monetization, let’s briefly understand how cashback apps operate:

- Partnerships with Retailers: Cashback apps collaborate with e-commerce stores and brands.

- User Purchases: When a user shops through the app, the retailer pays a commission.

- Cashback Distribution: The app shares a portion of the commission with the user as cashback.

Now, let’s explore how these apps turn a profit.

3. Primary Monetization Strategies of Cashback Apps

A. Affiliate Marketing Commissions

The biggest revenue source for cashback apps is affiliate marketing. Here’s how it works:

- The app partners with retailers via affiliate networks like CJ Affiliate, Rakuten Advertising, or ShareASale.

- When a user clicks on a retailer’s link within the app and makes a purchase, the retailer pays a commission (typically 1-10% of the sale).

- The app keeps a portion of this commission and passes the rest to the user as cashback.

Example: If a retailer pays a 10% commission on a $100 purchase, the app might give the user 5% ($5) and keep the remaining 5% ($5) as profit.

how-do-cashback-apps-make-money

B. Advertising and Sponsored Listings

Cashback apps also earn through display ads and sponsored placements:

- Featured Retailers: Brands pay to appear at the top of search results.

- Banner Ads: Display ads from third-party advertisers generate revenue.

- Email & Push Notifications: Promotional emails and notifications drive sales, earning affiliate commissions.

C. Subscription Fees and Premium Memberships

Some cashback apps offer premium memberships with enhanced benefits:

- Higher Cashback Rates: Users pay a monthly fee to unlock better rewards.

- Exclusive Deals: Premium members get access to special discounts.

- Ad-Free Experience: Some apps remove ads for paying users.

Example: Apps like Capital One Shopping and Drop offer premium tiers for frequent shoppers.

D. Selling User Data (Anonymized & Aggregated)

While controversial, some apps monetize user shopping behavior data:

- They analyze purchase trends and sell aggregated insights to brands and marketers.

- This data helps retailers optimize pricing, promotions, and ad targeting.

- Important: Reputable cashback apps anonymize data to protect user privacy.

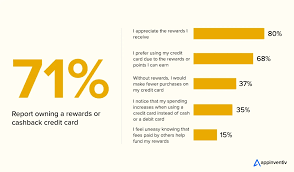

E. Credit Card and Financial Partnerships

Many cashback apps partner with banks and credit card companies:

- Co-Branded Credit Cards: Apps like Rakuten offer credit cards with extra cashback.

- Referral Commissions: Apps earn when users sign up for financial products.

F. In-App Currency and Withdrawal Fees

Some apps impose conditions on cashback withdrawals:

- Minimum Payout Thresholds: Users must accumulate a certain amount before cashing out.

- Fees for Instant Transfers: Charging a small fee for immediate PayPal or bank transfers.

- Expiring Rewards: Unused cashback may expire, allowing the app to retain unclaimed funds.

how-do-cashback-apps-make-money

4. Secondary Revenue Streams

Besides the primary methods, cashback apps also explore:

- White-Label Solutions: Licensing their cashback technology to other businesses.

- Gift Card Sales: Offering discounted gift cards and earning a margin.

- Surveys and Market Research: Paying users small rewards for completing surveys and selling insights.

5. Challenges in the Cashback App Business

While profitable, cashback apps face several challenges:

- High Customer Acquisition Costs (CAC): Competing with other apps for users.

- Dependence on Retailer Partnerships: If major retailers reduce commissions, profits drop.

- Fraud Prevention: Stopping users from exploiting referral systems.

6. Conclusion: A Win-Win for Apps and Users

Cashback apps make money through affiliate commissions, ads, subscriptions, data insights, and financial partnerships. While users enjoy savings, these apps generate revenue by acting as intermediaries between shoppers and retailers.

As the cashback industry grows, we can expect more innovative monetization strategies, making it a lucrative space for both businesses and consumers.

how-do-cashback-apps-make-money

Final Thoughts

If you’re a frequent online shopper, cashback apps can help you save significantly. Meanwhile, entrepreneurs can explore this business model by leveraging affiliate marketing and strategic partnerships.

FAQs: How Do Cashback Apps Make Money?

1. What is a cashback app?

A cashback app is a mobile or web application that offers users money back on purchases made through affiliated retailers or service providers. Users earn a percentage of their spending as cashback.

2. How do cashback apps make money if they give users money back?

Cashback apps earn money through affiliate commissions or referral fees from partner brands or retailers. When a user makes a purchase through the app, the retailer pays the app a commission for driving the sale. The app then shares a portion of this commission with the user as cashback.

3. What are affiliate commissions?

Affiliate commissions are payments made by retailers to cashback apps for referring customers who make purchases. These can be a fixed fee or a percentage of the sale amount.

4. Do cashback apps earn more than they give back to users?

Yes, typically. Cashback apps keep a portion of the affiliate commission they receive and give the rest to users. This difference is their profit margin.

5. Do cashback apps sell user data to make money?

Some cashback apps may analyze or sell anonymized user data to third parties for market research or advertising purposes. This is another potential revenue stream, but reputable apps usually disclose such practices in their privacy policy.

6. Do retailers pay cashback apps directly?

Yes. Retailers or their affiliate networks pay cashback apps for referring customers. These partnerships are the financial backbone of the cashback model.

7. Are there any hidden fees for users?

Most cashback apps are free for users and don’t charge fees. However, some may impose inactivity fees, minimum payout thresholds, or premium features for a fee.

8. Why do brands partner with cashback apps?

Retailers benefit from increased sales and visibility through cashback apps. They view the commissions as part of their marketing budget, making it a performance-based advertising channel.

9. Can cashback apps lose money?

Yes, especially if user acquisition costs are high or if they offer aggressive cashback promotions without sufficient affiliate income. New apps often operate at a loss to grow their user base.

10. Is it safe to use cashback apps?

Most major cashback apps are safe if you download them from trusted sources and review their privacy policies. Always check for app reviews and terms of service before signing up.