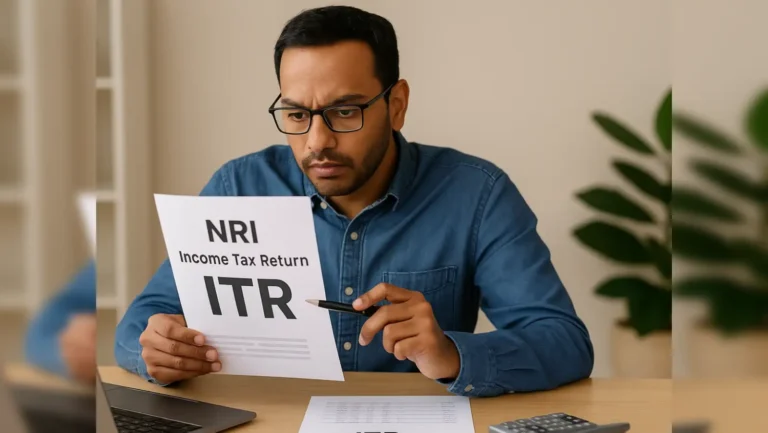

Here’s how you can save on taxes without investing in 2024

As a salaried employee, there are several tax-saving strategies you can consider to reduce your taxable income and optimize your tax liability. Let’s explore some of these options:

- Understand Your Tax Bracket: Begin by understanding your income tax bracket. Knowing the applicable tax rates based on your income level will help you plan effectively.

- Utilize Tax Deductions and Exemptions: Take advantage of tax deductions and exemptions available to salaried individuals. Some common ones include:

- Standard Deduction: Claim the standard deduction available for salaried employees.

- House Rent Allowance (HRA): If you pay rent, ensure you claim HRA exemptions.

- Leave Travel Allowance (LTA): Utilize LTA exemptions for travel expenses.

- Medical Reimbursements: Claim reimbursements for medical expenses.

- Invest in Tax-Saving Instruments: Consider investing in tax-saving instruments to reduce your taxable income. Some options include:

- Public Provident Fund (PPF): Contribute to PPF for tax benefits.

- Employee Provident Fund (EPF): Maximize your EPF contributions.

- National Pension System (NPS): Invest in NPS for additional tax benefits.

- Tax-Saving Fixed Deposits: Explore tax-saving FDs offered by banks.

- Maximize Contributions to Provident Fund: If your employer offers EPF or similar provident fund schemes, contribute the maximum allowable amount. These contributions are eligible for tax benefits.

- Optimize Health Insurance Coverage: Invest in a comprehensive health insurance policy for yourself and your family. Premiums paid for health insurance are tax-deductible under Section 80D.

- Plan Charitable Contributions: Donating to eligible charitable organizations can help you claim deductions under Section 80G. Be sure to keep proper documentation.

- Stay Informed About Tax Law Changes: Tax laws evolve, so stay updated on any changes. Consult a tax advisor to ensure you’re aware of all available deductions and exemptions1.

- Old Tax Regime:

- Encourages Savings: The old regime incentivizes saving through various exemptions and deductions.

- Ideal for High-Income Earners: If you have substantial income and make significant investments, the old regime may be more advantageous for you.

- New Tax Regime:

- Simplified Process: The new regime offers a simplified tax structure, making it easier for taxpayers.

- Lower Tax Rates: The new regime has lower tax rates, but you must forgo most deductions and exemptions.

- Suitable for Low-Investment Individuals: If you don’t claim deductions exceeding ₹1.5 lakhs annually, the new regime can benefit you.

- Tax-saving strategies without investments

- The Income Tax Act provides several deductions and exemptions that do not require investments, helping reduce your tax burden significantly.

- Claiming standard deduction

- All salaried individuals can claim a standard deduction of up to Rs 50,000 when filing their income tax return. This applies to both the old and new tax regimes.

- Utilising House Rent Allowance (HRA)

- If you live in a rented house, you can claim HRA exemption under the Income Tax Act, available only under the old tax regime. The exemption amount is determined by the lowest of the actual HRA received, the rent paid minus 10 per cent of your salary, or 40 per cent of your salary if you reside in a non-metropolitan city, or 50 per cent if you live in a metropolitan city.

- Tuition fees and hostel allowances for children

- Under Section 80C, you can claim a deduction for tuition fees paid for up to two children, with a limit of Rs1,50,000. Additionally, Section 10(14) allows tax exemption for special allowances provided by employers for children’s education and hostel expenses. These benefits are available only under the old tax regime.

Benefits of housing loan interest

Section 24(b) allows a deduction of up to Rs 2,00,000 for interest on a home loan for a self-occupied property. For loans taken for repair or reconstruction, the deduction limit is Rs 30,000. Principal repayment is deductible under Section 80C. These benefits are available under the old tax regime for self-occupied property, whereas for let-out property, interest can be claimed up to the rental income.

Education loan interest deduction

Section 80E allows a deduction for the interest paid on education loans for higher education, with no upper limit on the amount. The deduction can be claimed for up to eight years. This benefit is available only under the old tax regime.

Savings account interest deduction

Section 80TTA allows a deduction of up to Rs 10,000 on interest from savings accounts. For senior citizens, Section 80TTB allows a deduction of up to Rs 50,000 on interest from any deposit, including fixed deposits. These benefits are available only under the old tax regime.

Leave Travel Allowance (LTA) claims

Section 10(5) allows employees to claim LTA for travel expenses within India for themselves and their families, up to two journeys in four calendar years. This benefit is available only under the old tax regime.

Employees Provident Fund (EPF) contributions

Contributions to EPF are deductible under Section 80C, up to Rs.1,50,000. This benefit is available only under the old tax regime.

Health insurance premium deductions

Section 80D allows a deduction for Mediclaim premiums and contributions to the Central Government Health Scheme. The deduction is up to Rs.25,000 for premiums for yourself, spouse, and children, and Rs.75,000 if premiums are paid for senior citizen parents. This benefit is available only under the old tax regime.

Life insurance premium benefits

Premiums paid for life insurance policies are deductible under Section 80C, up to Rs.1,50,000. This benefit is available only under the old tax regime.

Donations and charity deductions

Donations to specified funds like the PM Cares Fund and charitable institutions are deductible under Section 80G, with deductions up to 50% of the donated amount. This benefit is available only under the old tax regime.

Adjusting losses against income

Income tax laws allow the set-off and carry forward losses. Losses can be adjusted against profits or income in the same year or carried forward to subsequent years, reducing your taxable income.

Agricultural income exemptions

Under the new tax regime, agricultural income is not subject to income tax. However, it is included in the total income for rate purposes under the partial integration method, resulting in higher tax rates for non-agricultural income.

Remember that effective tax planning can significantly impact your overall financial health. Consult a financial advisor or tax professional to tailor these strategies to your specific situation. If you have any more questions or need further assistance, feel free to ask! 😊