Bitcoin’s Bull Run: BlackRock’s $184M Purchase to Ignite the Market

Bitcoin’s Bull Run: BlackRock’s $184M Purchase to Ignite the Market

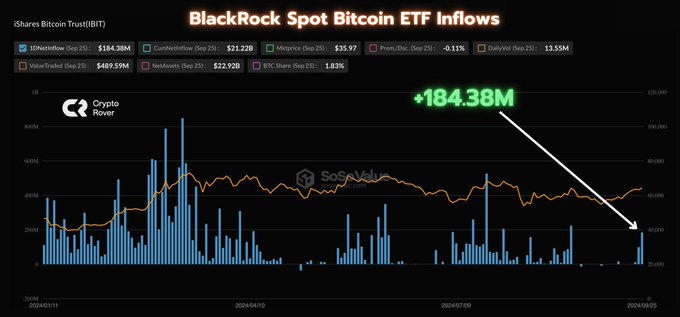

BlackRock, the world’s largest asset manager, made waves in the crypto market with its recent purchase of $184.38 million worth of Bitcoin on September 26, 2024. This move adds to its growing Bitcoin holdings through its iShares Bitcoin Trust (IBIT) and signals continued confidence in the digital asset’s future.

BlackRock’s Bitcoin Holdings

Following this purchase, BlackRock now holds 358.08K BTC, valued at approximately $22.86 billion, according to Arkham Intelligence. The company’s increasing involvement in Bitcoin reflects a strategic belief in its potential as a store of value and hedge against inflation, particularly amid growing economic instability.

BlackRock’s interest in Bitcoin also ties into its larger strategy, including its filing for a Bitcoin spot ETF, which is still pending regulatory approval. This positions the asset manager to further capitalize on Bitcoin’s potential if the ETF is approved.

Bitcoin as a Hedge Against Global Uncertainty

Recently, BlackRock acknowledged Bitcoin’s utility as a hedge against global uncertainty and declining trust in governments, banks, and fiat currencies. The decentralized and transparent nature of Bitcoin offers an appealing alternative to traditional financial systems, particularly during times of instability. This growing institutional interest in Bitcoin has drawn attention to its potential to safeguard wealth against inflation and geopolitical risks.

Bitcoin Price and Market Impact

At the time of the purchase, the price of Bitcoin was $63,855.46, showing a 7.2% increase over the past week. This rise has been partly driven by increased interest from major institutions like BlackRock. Analysts predict further bullish momentum, with some forecasting that Bitcoin could reach $87,917 by November, according to CryptonewsZ.

BlackRock’s latest move is expected to attract other institutional investors, further boosting Bitcoin’s adoption and market price. Recent developments in the crypto space, such as clearer regulatory frameworks and growing mainstream acceptance, are reinforcing this positive trend.

This large-scale Bitcoin acquisition by BlackRock underscores the firm’s long-term commitment to the digital asset space, reinforcing Bitcoin’s growing role in institutional portfolios.

Bitcoin’s Bull Run: BlackRock’s $184M Purchase to Ignite the Market